A great deal of divorce litigation involves how to characterize money changing hands from one of the parties’ family. One of the parties will argue that money her family provided to the parties was never intended as a gift, but rather is a “loan” that now needs to be repaid. This commonly happens when the parties receive money to purchase a home or a business. The Court will look at these transactions with great skepticism.

Consider a trial conducted in Oakland County Circuit Court. In this case, both the husband and his father testified that the father had lent the parties’ money not only to purchase a home, but also to start and operate an auto body repair shop. A purported loan agreement was entered into evidence. One would think that this should suffice to establish a valid debt. However, the judge found that the fact the parties had never made payments over the six year period leading up to the divorce essentially turned the loan into a gift, and that there was no longer an expectation of repayment. Thus, the husband couldn’t include this liability when calculating the equity in these assets.

The Michigan Court of Appeals upheld the judge’s ruling and cited a case from Illinois with a similar fact pattern. In that case, the court noted that a “donative intent” is presumed in transfers from parents to children. The court also noted that the alleged loan contained no interest rate and that no payments had ever been made to the parents.

This isn’t to say that a judge will never rule that parties owe extended family members for money they borrowed. Rather, what these cases tell us is that judges will be skeptical when the fact of the matter is that the family treated this transaction more as a gift than a loan. If a party is attempting to prove that money is owed to a family member, that party should be prepared to prove that there was an expectation of repayment and that, in fact, payments were made on that agreement. Ideally the loan agreement is in writing, and if the loan was intended to be secured by real estate or other assets, the party alleging the debt should show that a mortgage or other lien was recorded in the public record. This can be problematic in situations where a home is being purchased with a down payment that is borrowed from family members, as the mortgage company often requires the parties’ parents to sign a ‘gift letter.”

In some cases, the family members that lent the money should consult with an attorney of their own to find out how to secure funds they are owed.

Establishing or disproving family loans can be tricky in divorce cases. It is essential that you consult with an experienced attorney and develop a strategy to prove your case.

About ADAM (American Divorce Association for Men)

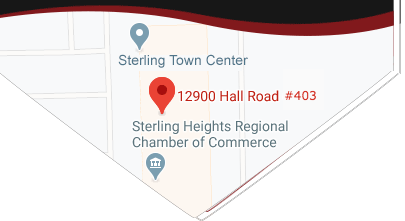

The American Divorce Association for Men (ADAM) is a group of highly qualified attorneys who advocate for men’s rights in divorce, child custody and parenting time, paternity, support, property settlement, post judgment modifications, and other family law matters. Since 1988, ADAM has been aggressive, diligent, and uncompromising when representing their clients. A team of compassionate and skilled family law attorneys, ADAM is dedicated to being Michigan’s leading divorce attorneys for men and practices a policy of integrity in all dealings.